Pursuing PSLF and planning to switch from SAVE to PAYE after residency does not work. You are better off choosing the best plan up front or switching to PAYE or IBR while still in residency.

You will not be able to change to IBR once your income increases, nor will you be able to switch to the 10-Year Standard Repayment plan.

Choose the correct repayment plan for PSLF up front and stick with it for the 120 payments.

Let’s assume you are an average medical student and have just started residency. You are making an average $60,000 residency salary, and you have $200,000 in outstanding medical student loans at 7%. You are single and are planning on a total of 4 years of residency/fellowship. As an attending, your income will go to$350,000. To make things simple, you do not have any undergraduate loans. You intend to seek PSLF.

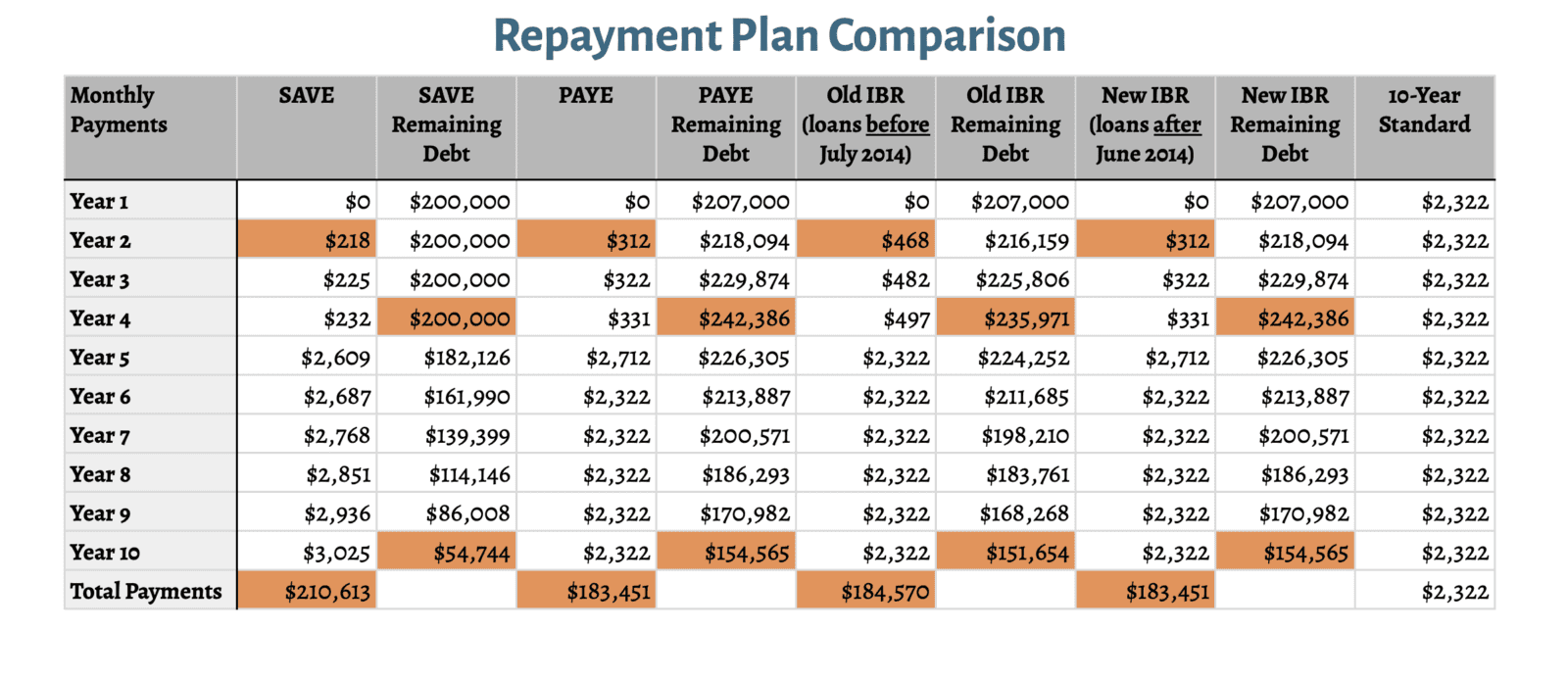

Looking at the above table, you choose SAVE as your payment plan because it has the lowest payments up front and the debt increases the least of the three income-driven plans due to SAVE’s interest rate subsidy. Even though your total payments will be higher after ten years in SAVE, you figure you can switch to a new, lower payment later. You are also pretty savvy and consolidated your loans at graduation and started with $0/month payments your first year.

Four years later you are receiving your attending salary, and it’s time to report your increased income to MOHELA. Your loan balance is still $200,000,, but your SAVE payment is going to jump to around $2,609. That’s more than the 10-Year Standard Repayment Plan payment of $2,322 that you calculated when you started your repayment, and you realize it is only going to increase from there. What can you do?

Nothing if you are still planning on PSLF. There is nothing you can do at this point to reduce your payments and stay eligible for PSLF.

You will not be able to change from SAVE to IBR once your income increases.

Some people are thinking of changing from SAVE to IBR to get the payment cap. To be eligible for IBR, your IBR payment, calculated as 15% of AGI (10% of AGI if all of your loans were after June 2014) minus 150% of the poverty level must be lower than the 10-Year Standard Repayment.

If your loans are less than your income, unfortunately, your income is too high. You are therefore ineligible to change to a new IBR repayment plan.

If your loans are equal to or greater than your income, you can switch to IBR. Problem is your payments will go up substantially. If you stick with SAVE, and your loan balances are high, you will never hit the 10-year payment cap and in many cases never even increase to the IBR payment.

You will not be able to change from SAVE to the 10-Year Standard Repayment plan and continue to pursue PSLF.

If you are thinking of changing from SAVE to the 10-Year Standard Repayment plan, you can’t do that either.

I think a lot of the confusion with this one comes from the way the government websites lump together the 10-Year Standard Repayment Plan and the 30-Year Consolidated Repayment Plan in their discussions. They are both regularly referred to as the “Standard Repayment Plan.”

Here is why you can’t do it.

If a borrower changes plans, the repayment period is the period provided under the borrower’s new repayment plan, calculated from the date the loan initially entered repayment.

Code of Federal Regulations, Title 34: Section 685.210 –Choice of Repayment Plan.

This rule means that if you want to change to the 10-Year Repayment Plan, the amortization clock started back when you began the SAVE payments. Your new “Standard Repayment Plan” will require you to completely pay off the loans by the end of the original ten year period. You could opt for a “Standard Repayment Plan” that is longer than ten years, but those payments will not be eligible for PSLF.

I have to give Heather Jarvis credit for the documentation reference. After looking for supporting documentation for months, I couldn’t find the proof I’m sure many people are going to need. It finally dawned on me to ask Heather Jarvis. She kindly provided the link to the correct reg. I don’t believe her site was meant to be public so here is the link directly to 34 CFR Section 685.210. The text I quoted above is located in Subsection (b)(2)(ii).

What if I made the Wrong Choice Initially?

If you made the wrong choice when you first signed up for PSLF, you might be able to do something about it before your income increases. The second half of (b) Changing Repayment Plans (2)(ii) talks about moving to an income-contingent or income-based plan. You can do that but, it doesn’t make sense after your income goes up.

You can switch from PAYE to SAVE, but that is almost certainly not a good idea. The big decision to be made between PAYE and SAVE is when you start your payments. You compare the benefit of the interest subsidy and lower up front payments of SAVE versus the cap on payments of PAYE and of course, total student loan debt, etc.

You can switch from IBR to SAVE or PAYE. There is a good chance this is a good idea as IBR is based on 15% of your salary (if you have loans from before July 2014) and SAVE and PAYE are based on 10%. If you wait until after July 1, 2024, PAYE will no longer be an option. SAVE will not be a good option because you lose the payment cap available while in IBR.

Get in the Correct Plan the Day you Graduate

As we have been telling people all along; make the right choice up front. In this case, you need to choose between the reduced amount of accrued debt with the SAVE plan or the lower total payments with the PAYE plan.

Don’t count on being able to fix it later. Either learn the rules and do the math to determine the best option for you or hire a competent advisor to do it for you.

We have posted additional information on this subject. Take a look at Switching from SAVE to another Repayment Plan, Part 2 if you are interested in some of the specific calculations involved.

Hello Chris,

I have a question. I am on PAYE with PSLF. I finished residency and now am in fellowship. My question is: will I get kicked out of PAYE and thus, PSLF when I become an attending because I will making more money and no longer have partial financial hardship? If so, do I need to switch to REPAY before that?

Thanks!

Maria,

Thanks for your question.

You will not be kicked out of PAYE as long as you keep up with your recertifications and payments.

The benefit of RePAYE is the reduced subsidized interest while your income is low. You would not want to change to REPAYE from PAYE just before your income increases. The benefit of PAYE is the repayment cap. As long as you stay in PAYE, your repayments will not go higher than the standard 10-year repayments as calculated when you first started your income driven repayments.

I hope this helps

Chris Hansen, CFP®

Hi Chris,

I had a lot of questions initially, but after reading thorough the answers for comments I think I understand most of it, just was wandering if got several point correct. I am about 70 months into PSLF on IBR plan and my IDR was just denied. I have remaining approximately 200K in loans (not qualifying for PAYE as they are from 2006 on).

My total family income is kind of stabilized at 300-320K/year and hopefully will not fluctuate either way much.

I calculated REPAYE at approx. 2400/months and my standard repayment was initially calculated at approx. 2750/month. I need approximately 4 more years to finish PSLF (hopefully). If you could tell your thoughts on these questions:

1. There are some statements online that if I switch now to REPAYE my payments will reset and I will need 120 from the scratch, but readers above say it’s not true. Do you happen to know if what is really the case?

2. Does it make sense to switch for relatively small savings, but loose IBR cap protection? If my discretionary income somehow goes up even not by much I can see REPAYE payments easily becoming higher that standard. I wouldn’t be able to go back to standard anymore, correct?

3. What exactly do I ask servicer, to let me exercise my right to stay on PSLF track while making standard 10 year payment? Is there a procedure for it?

I appreciate all your time and efforts you putting into this article and answers.

Ilya,

Sorry for the delay, been extremely busy lately.

I’m not sure that I understand all of the statements in your background information. What do you mean by “my IDR was just denied?”

I will try to address the questions without getting into too much of your specifics.

You will not be able to go back to the IBR plan if your repayments are higher than the 10-year payments either.

I hope this helps!

Chris Hansen, CFP®

Non-doctor here (a lawyer) but I’ve found your post and responses very helpful for my own situation. I’m in about $90K of student loan debt and I’ve made 56 qualifying payments into the PSLF program through IBR. I’m in the process of switching from IBR to RPAYE. I wanted to put in my two cents on switching. If you’re looking to switch, be warned, it’s a process. It will take me approximately three months to switch off IBR to RPAYE. I will not be making qualifying payments to PSLF during that time which will delay the 10 years that I have to have my loans forgiven. However, I’ve crunched the numbers and it would be worth it in the short term. I’ve gotten a lot of misinformation and wrong information from various representatives at Fedloan Servicing regarding my status during switching. The initial person I spoke to was very helpful and explained the process but I have been calling to following up and some of the representatives have not been helpful. First, you must get off IBR and pay a $5 minimum payment. It should take two months or so. During that time, make sure they put your loans in administrative forbearance (They kept telling me mine were but they were not and I kept getting notified that payments were late. I finally called today and they fixed it). After you get a bill for $5 and pay it manually, they will then review your application for RPAYE. This should take a month or so. You have to be your own advocate and don’t be afraid to demand to speak to a supervisor.

I do have a question, how does marriage affect your student loans? I know if I file jointly my (potential) spouse’s income will count for all plans. If I file separately, both incomes will only count towards RPAYE. Can you switch from RPAYE to PAYE before you get married to avail yourself of the lower rate? Do you know if that process is as lengthly as switching off IBR?

As I said, thank you! I’m trying to become my own expert on student loans and I found your breakdown immensely helpful.

Hi Leann,

Thanks for the post. It helps to share the difficulties of dealing with these servicers so others can be prepared.

IBR is the only plan that has a “Leaving the Plan” penalty. StudentAid.gov states “If you choose to leave this plan, you will be placed on the Standard Repayment Plan. If you want to change from the Standard Repayment Plan to a different repayment plan, you must first make at least one payment under the Standard Repayment Plan, or one payment under a reduced-payment forbearance (you may request a reduced-payment forbearance if you can’t afford the Standard Repayment Plan payment)”

Your delay probably came from their confusion around the forbearance piece.

Each of the Income-driven repayment (IDR) plans have their own rules around income considered for the calculation. REPAYE is the only plan that is based on both salaries, regardless of how you file your taxes. If you switch from REPAYE to PAYE, the transition should be much easier. StudentAid.gov states “If you choose to leave this plan, you may change to any other repayment plan for which you are eligible.”

Keep in mind, every time you switch repayment plans, your accrued interest is added to your principal balance and begins being charged interest also.

I hope this helps!

Chris Hansen, CFP®

Chris,

I just finished my fellowship and started working as an attending September 2018. I am a subspecialty surgeon and my annual salary is 450,000. I have been in IBR for 8 total years during my training, I applied for PSLF and am waiting for their review, but see no reason that I would not be eligible. The automated review did not have all my repayents on it and I was told the manual review can take up to a year.

I was told with my new salary to switch to REPAYE as there is no salary cap for that plan and I would retain my eligibility for PSLF. Since I just started my job mid September my annual salary for this year is not that high but my 2017 salary is a fellows salary. Is REPAYE the best option? I only have two more years of repayment before forgiveness if everything works out but is there a salary cap for PAYE? Would it make sense to do a different type of repayment this year and switch to REPAYE when my 2018 tax returns are complete?

Tanya,

Thanks for reaching out.

I believe that whoever is giving you the advice to switch to REPAYE has the concept backward. There is no such thing as a “salary cap” with any of the IDR repayment plans.

PAYE and IBR both have repayment caps. The repayment cap is what you would have been paying had you chosen the 10-year standard repayment plan when you first started repaying your student loans. Repayment caps are a good thing! There is no repayment cap with REPAYE. That means that your repayment will be based entirely on your $450,000 income, regardless of how large your student loans are. This is usually a bad thing!

I don’t have all of the details on your student loans, income, family, etc. so I can’t give you specific advice, but… Switching to REPAYE from IBR after your salary has increased sounds like it might be the absolute worst thing you can do at this time.

You did not mention what type of federal loans you have. Please tell me they are all Direct loans and not FFEL loans. FFEL loans are not eligible for PSLF.

I hope this helps. I highly recommend you hire somebody who knows what they’re doing with student loans. We can analyze your loans for $500. StudentLoanPlanner.com has a range of pricing.

Chris,

I’m thinking of switching IBR to REPAYE. I’ve been in IBR for the past 6 years and have been annually submitting my employment for the past six years. Per my loan details from Fedloan, I’ve 73 qualifying payments for PSLF.

A little detail on my loans- I’ve consolidated subsidized and unsubsidized of about $160k and under IBR I currently pay $687 a month. I make $115k and expect my salary to increase by 7% each year. So I could be at $140k in the next 3 years. My wife doesn’t work and doesn’t have any student loans. We’ve two kids and my mother in law to take care of.

I was doing some research to see how to lower my monthly payments from $687, so I came across RePaye, which will bring my payments down to about $415 a month. I called Fedloan servicing to confirm that RePaye qualifies for PSLF and that when I switch I will not loose my 73 qualifying payments and they confirmed that I will not.

However, I would like to know if there are any implications of switching to REPaye after making over half of the qualifying payments towards PSLF under IBR? Also, will the monthly payments hunt me back later when my salary increases to around $140k or more? Will my payments under RePaye be bigger than IBR plan? Could I switch again to another payment plan, like back to IBR?

Thanks in advance.

Boima,

Sorry for the delayed response, I have been out of town helping out family.

From the information you have provided, REPAYE looks like it would be an excellent option.

IBR and PAYE have the benefit of a payment cap equal to the amount you would pay to the 10-year standard repayment amount. On a $160,000 loan, at 6%, the 10-year repayment amount would be around $1,770 a month. At $140,000, your payments will be well below that figure.

If you switch from IBR to REPAYE, they will add all of the accrued interest to your principal balance and begin charging interest on the total debt. Some of this will be offset by the interest forgiveness benefit in REPAYE as you are paying less than the interest being charged every month.

If your income increases dramatically above your current estimates, you can move back to IBR. The newly accrued interest will be capitalized at that point.

I hope this helps!

Chris Hansen, CFP®

My husband is currently in PAYE in yr 5 of 6 for residency (started in July 2015.) We are a family of 5 and his loans started at $260k but have grown to $320k with interest over the past 5 years. We have submitted the paperwork for his loans to qualify for PSLF. Unfortunately we realized in January 2018 that there is the REPAYE option (we didn’t know about this when it started in 2015) and even with our interest being capitalized it seems like a better plan. We aren’t sure how to figure out if it’s better to switch now or to stay on PAYE. What is the best way to determine when/if to switch? My husband is in Radiology so we are not sure if it’s worth it to pursue PSLF or live minimally and pay off via private practice. Any insight would be much appreciated.

Nicole,

Thanks for reaching out to us.

Having the loans increase while in residency is never a good feeling. Try not to let it bother you too much while pursuing PSLF. One of the best things you can do for your peace of mind is to save the difference between the PAYE payments and what you would be making on the 10-year standard repayment plan into a separate account. If PSLF is no longer viable for you, you can take this money and pay it toward the loans.

I realize that advice is much easier to give than it is to implement, especially with a family of five trying to survive on a resident’s salary. My heart goes out to you. The path your family has chosen can be difficult.

Without having all of the information about salaries, interest rates, etc., I think you may want to stick with your current PAYE repayments.

You husband has approximately one and a half years to go before his income increases substantially. If you are still in PAYE, your payment will be capped at the 10-year standard repayment amount. As a radiologist, you may find this cap to result in significant savings. If you switch to RePAYE, there is no cap on the repayments calculation.

Additionally, if you leave the PAYE plan, $26,000 (10% of the initial loan balances) of your accrued interest will capitalize. That means you will start being charged interest on that $26,000 of interest. If you switch back to PAYE, to take advantage of the cap, 100% of your accrued interest will be capitalized.

Regardless of how the math turns out, I give all of my residents the same advice I give to my son. Don’t use debt or income potential as your primary influence when making a career decision. Being a doctor is hard work with plenty of stress. The more you enjoy the environment and the work itself, the less chance of burnout. When it comes time to move on from residency and fellowship, match up the private offers to the PSLF offers with the loans in mind.

I hope this helps!

Chris Hansen, CFP®

I am currently in a IBR plan, and have been for the past 6 years of residency. I just got into a CT Fellowship program, which I will be in for 2 years. I have been submitting the ECF annually and have about 66 months of “qualified payments.” My question is whether I should consider moving to a PAYE repayment plan for the remaining 54 months. This would help with my monthly payments at 10% (PAYE) vs. 15% for IBR. Would my 66 month’s of qualified payments hold and the monthly payments be adjusted to the 10% for PAYE? I am single but engaged and planning to get married in about 6 months.. Any guidance would be greatly appreciated.

Hi Evelyn,

Thanks for reaching out to us.

It sounds like you have done an excellent job of tracking your payments and confirming your employer eligibility. When you say you have 66 months of “qualified payments,” I assume you have that in writing from Fedloan Servicing.

There is no reason for anybody to choose IBR over PAYE unless they have to. As you stated, IBR is based on 15% of your available income and PAYE is based on 10%. Both IBR and PAYE allow for using only your income and excluding your spouse’s income when determining your repayment. If you had an outstanding federal loan on the books as of October 1, 2007, you would not be eligible for PAYE. If you are eligible for PAYE, given the information you have provided, it probably makes sense for you to switch to PAYE.

Changing to PAYE from IBR requires you to apply for a new repayment plan. Make sure you do not consolidate your loans during that process. If you consolidate your loans, the PSLF clock starts over, and you lose your previously made qualified repayments.

Good luck! I hope this helps.

Hi Chris,

I am currently an attending physician 5 years into student loan repayment. I plan on participating in the Public Student Loan Forgiveness program and have been submitting my ECF forms annually. My loans started off at 263k in principle but are up to 328k after interest has accrued during repayment. I have been participating in the IBR type repayment and I consolidated my loans right after medical school in order to comply with PSLF requriements. My question is is can I switch from IBR repayment to PAYE in order to lessen my monthly payments and still be eligable for PSLF in 5 years? I am curious about this because PAYE is based on 10% annual salary vs. the 15% of IBR. My loans are a direct subsidized and direct subsidized loan that were taken out after 2008 when I started medical school. And my current salary is 220k annually. Thanks for your help.

Sincerely,

David

Hi David,

Thanks for taking the time to reach out and asking a question. We enjoy interacting with people and clarifying our articles.

I have struggled with how to respond to your questions for a couple of reasons. Mostly, we do not have enough information to give you a specific “recommendation”. We can, however, provide some facts that you can use to get comfortable with your decision on how to proceed.

– You can switch from one income-driven repayment plan to a different one without losing your accrued eligible PSLF payments.

– You are eligible for PAYE if…

– you did not have an outstanding federal student loan prior to October 1, 2017, and…

– You currently have a partial financial hardship, which is defined by your calculated PAYE repayment being less than your 10-year standard repayment amount.

Keep the following in mind:

– Don’t forget to include your spouse’s income when calculating your new repayment if you are married, or the tax consequences of filing MFS (Married Filing Separately).

– All of your accrued interest to date will capitalize if you change repayment plans. Your interest calculation will be based on the current total debt ($328,000) instead of the original principle. This means your debt will grow even faster. Not a problem if you receive PSLF, but something to be aware of.

I hope this helps!

Thanks. We decided on Consolidation, PAYE plan with PSLF. As long as qualified for PSFL this is the least out of pocket.

The federal loan site comparing the repayment plans states that the unpaid interest capitalized in the PAYE plan is capped at 10% of the original loan principal at the start of the PAYE plan. The table comparing the different plans does not seem to cap the interest growth in the PAYE example which I think would be $20K. Am I missing something in my interpretation of the unpaid interest capitalization?

Ron,

Interest capitalization is one of the most confusing concepts when looking at student loans. In PAYE, the interest accrues according to the interest rate of the loan. Fortunately, while you are making PAYE repayments, you do not pay interest on the accruing unpaid interest. If you leave PAYE or if your income increases to the point you are no longer making payments based on your income, your accrued interest is subject to capitalization. There is a cap on PAYE concerning how much of your accrued interest can be capitalized. That cap is 10% of your original loan balance when you entered the PAYE plan. That means the $20K in your question gets added to the principal, and you have to start paying interest on that $20K in addition to the interest you were paying on the loan balances when you began the PAYE plan. The remaining accrued interest that did not capitalize is still owed by you. The only benefit is that you do not have to pay interest on that remaining interest.

In the table in the above post, the interest is accruing through Year 4. In Year 5, the PAYE repayment cap goes into effect which means the repayments are no longer based on income. This triggers the capitalization event. $20K is added to the principal and begins getting charged interest. The remaining approximately $25K interest continues to be owed but does not get charged interest.

I hope this helps!

Chris Hansen, CFP®

Thanks, Is the non capitalized remaining debt included in the total remaining debt in the table after 10 years? Why does consolidating the loans result in $0/month payment for the first year?

Ron,

Yes, the total remaining debt columns include the accrued interest that has not been capitalized.

The $0 first year repayment is based on your income from your tax return the year prior to consolidating your loans and applying for an Income Driven Repayment plan. Most medical students have little or no income while in school. The IDR payment is based on this income so there would be 12 zero dollar, PSLF eligible repayments for the first year.

Hope that helps!

Chris Hansen, CFP®

Hi Chris,

I have a question, if I decide to do RePAYE for my 4 year residency, and then decide to refinance my loans during my 4th year of residency is this possible?

Thanks,

Joe Skopek

Joseph,

In your question, you asked if you can refinance your loan in your fourth year of residency. The answer to that is, absolutely yes. You can refinance your loans anytime you want. Of course, if you refinance your loans, they will no longer be eligible for PSLF.

If you’re asking about the ability to change your payment plan in your fourth year to either PAYE or IBR, the answer is also yes. Just make sure you apply to switch repayment plans before your income increases so you don’t misrepresent any facts on the Income Drive Repayment (IDR) Plan Request.

If you’re asking if you can consolidate your loan in your fourth year, the answer is yes, but don’t do it. If you consolidate your loan, it is considered an entirely new loan and all previous PSLF eligible payments are erased.

I hope I answered your question!

Hi Chris,

I am in a similar situation to BD, I am in the last year of my medical training and soon my income will disqualify me from the IBR plan I am on now. So far I have submitted PSLF employer forms and have 6 years of qualifying payments. My loans are $300K currently. Does this mean I have no way of qualifying for PSLF as the 10 year standard plan will force me to pay off my entire loan? Would I be able to switch to RePAYE now to retain eligibility?

Thanks for the advice

Hi Al,

Great question, and a frequent misconception for a lot of physicians.

If you are in PAYE, IBR, or RePAYE and your salary increases to the point that you no longer qualify for those repayment plans, they do not kick you out of your current repayment plan. Instead, your repayment amount will adjust based on your new income.

If you are in IBR or RePAYE, your repayment will be capped at the 10-year standard repayment amount that you would have paid had you started in the standard 10-year repayment plan when you first began repaying your loans. This cap on your repayment amount is the reason you want to remain in your current plan after your income increases dramatically.

If you were in RePAYE, your repayment would increase to the newly calculated amount (10% minus 150% of the poverty level) regardless of the 10-year standard repayment amount. In other words, you would not have the cap that you have with PAYE and IBR.

I hope this helps.

Chris Hansen, CFP®

Hi Chris,

If I want to switch from REPAYE to IBR before my income goes up to cap my possible payments, do they make you recertify when you switch? My income according to FedLoan is behind by a year because it uses last years taxes, but if I wait until a few months before low REPAYE payments stop my current taxes would put me over the hardship and I wouldn’t be able to switch.

Graham,

You will need to recertify your income when you apply for a new IDR repayment plan. You want to make this change before your income increases dramatically.

Make sure you will benefit from the payment cap with IBR. Most people do fine sticking with RePAYE, which is based on 10% of your income, versus IBR, which is based on 15% of your income.

Best of luck!

Chris Hansen, CFP®

Thank you for this article. I have a slightly different predicament where I am now 2 years out from a 3 year residency. I have been making IBR payments for the past 5 years but this year my loan servicer told me I didn’t qualify for IBR based on my salary. At this point it seems my only option is Standard Repayment but if Standard Repayment forces me to make all my payments within the original 10 year window (i.e. the next 5 years) they are essentially forcing me out of PSLF when it’s clearly been stated that income doesn’t affect PSLF status. I’ve also read that salary doesn’t disqualify you from IBR as well. This is all a bit surprising since I don’t make a significant amount comparably in the medical field (<$200,000). Thank you for the help!

BD, You’re absolutely right, you must remain in the IBR repayment-plan. Refer your servicer to the qualifying repayment plans. Is your servicer FedLoan Servicing? If not, you have not submitted your PSLF Employer Certification Form yet. You should do this every single year to make sure they are tracking your payments correctly. As soon as you submit this form, they will transfer you to FedLoan Servicing and report back to you exactly how many qualifying payments you have made. Check out the Application Process link for more information. Good luck! Keep on them until they give you the right answer.

This article does a great job of explaining why it doesn’t make sense to switch plans AFTER becoming an attending. However, does anyone foresee any PSLF issues if one switches from REPAYE to PAYE in the last year of residency?

Lucas,

Great question. I have a follow up article written Switching from RePAYE to another Repayment Plan, Part 2. I apologize, I left this article as a draft and had not hit the publish button till I saw your comment. The last section of the article addresses your question. If you will benefit from the cap, make the switch. If you will not benefit from the cap, you may want to stay with RePAYE for more interest forgiveness. It all depends on the balance of your loans, your income and your spouse’s income (and loans). Let me know if I can help any further.