The only time switching from SAVE to PAYE while still in residency will help is if your loan balance is low compared to your increasing income.

I discussed why switching after residency does not work in my blog post here. I thought it would be helpful to go through some specific scenarios on switching before leaving residency.

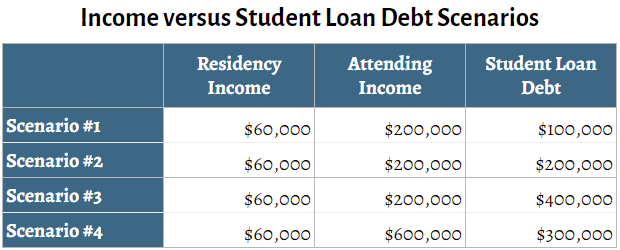

There are four scenarios that you, as a resident, are going to find yourself in when you make the transition from resident pay to attending pay. For the sake of simplicity, these four scenarios do not take into account your spouse’s student loan debt or income.

The Four Scenarios

- Your income as an attending will rise by around four times to be around two times your student loan debt

- Your income as an attending will rise by around four times to be approximately equal to your student loan debt

- Your income as an attending will rise by around four times to be around one half of your student loan debt

- Your income as an attending will rise by around ten times or more to be approximately one and a half times your student loan debt

To make this more realistic, I will assign actual dollar amounts to the scenarios. The real dollars do not matter as much when deciding on whether or not you can change Income-Driven Repayment (IDR) plans when you leave residency. The ratios will drive your decision.

I will assume that as a resident you started an average of $60,000 per year and that you will spend four years in residency/fellowship. Your income will rise to $200,000 after residency in scenarios 1,2 and 3, and to $600,000 in scenario 4. The original loan balances will be $100,000, $200,000, $400,000 and $300,000 respectively.

Scenario One: Your income as an attending will rise by four times to be around two times your student loan debt

Remember resident income started at $60,000, Attending income will be $200,000 and the initial loan balance is $100,000 at 7%.

After four years of residency in SAVE you will have:

| Years in PSLF | 10-Year Standard | SAVE | Total Payments | Total Debt |

|---|---|---|---|---|

| 4 | $1,161/month | $232/month | $8,102 | $100,000 |

If you want to switch to a different repayment plan, your payments would be as follows:

| PSLF Year | SAVE | PAYE | IBR (old) |

|---|---|---|---|

| 5 | $1,359/month | $1,462/month | $2,192/month |

| 10 | $1,575/month | $1,694/month | $2,541/month |

Since both PAYE and IBR calculations are greater than the 10-Year Standard Repayment Plan, you cannot switch to either plan.

Scenario Two: Your income as an attending will rise by four times to be approximately equal to your student loan debt

Remember resident income started at $60,000, Attending income will be $200,000 and the initial loan balance is $200,000 at 7%.

After four years of residency in SAVE you will have:

| Years in PSLF | 10-Year Standard | SAVE | Total Payments | Total Debt |

|---|---|---|---|---|

| 4 | $2,322/month | $232/month | $8,102 | $200,000 |

If you want to switch to a different repayment plan, your payments would be as follows:

| PSLF Year | SAVE | PAYE | IBR (old) |

|---|---|---|---|

| 5 | $1,359/month | $1,462/month | $2,192/month |

| 10 | $1,575/month | $1,694/month | $2,541/month |

You are eligible to switch to PAYE (other conditions exist), but why would you? SAVE still has the lowest repayments.

Scenario Three: Your income as an attending will rise by four times to be around one half of your student loan debt

Remember resident income started at $60,000, Attending income will be $200,000 and the initial loan balance is $400,000 at 7%.

After four years of residency in SAVE you will have:

| Years in PSLF | 10-Year Standard | SAVE | Total Payments | Total Debt |

|---|---|---|---|---|

| 4 | $4,644/month | $232/month | $8,102 | $400,000 |

If you want to switch to a different repayment plan, your payments would be as follows:

| PSLF Year | SAVE | PAYE | IBR (old) |

|---|---|---|---|

| 5 | $1,359/month | $1,462/month | $2,192/month |

| 10 | $1,575/month | $1,694/month | $2,541/month |

Very similar to Scenario Two. You are eligible to switch to both the IBR and PAYE (other conditions exist), but why would you? SAVE has the lowest repayments.

Scenario Four: Your income as an attending will rise by ten times or more to be approximately one and a half times your student loan debt

Remember resident income started at $60,000, Attending income will be $450,000 and the initial loan balance is $300,000 at 7%.

After four years of residency in SAVE you will have:

| Years in PSLF | 10-Year Standard | SAVE | Total Payments | Total Debt |

|---|---|---|---|---|

| 4 | $3,483/month | $232/month | $8,102 | $300,000 |

If you want to switch to a different repayment plan, your payments would be as follows:

| PSLF Year | SAVE | PAYE | IBR (old) |

|---|---|---|---|

| 5 | $3,442/month | $3,545/month | $5,317/month |

| 10 | $3,991/month | $4,109/month | $6,164/month |

This scenario also does not work for the same reasons discussed in Scenario #1.

When Would Switching Possibly Work?

The only way making a switch in IDRs would work is if you were to switch from SAVE to PAYE before your income increases. You will save all of the unpaid interest while in residency by starting in SAVE and subsequently moving to PAYE to take advantage of the PAYE 10-Year Standard payment cap. This technique will lower the total amount of your loan, including accrued interest, when your income increases.

If your loan is so large that you will never hit the 10-Year Standard payment, you should just stick with SAVE. If you are in a situation where the 10-Year Standard payment cap comes into play, your loan balance in relation to your income must be relatively low.

How to Make the Switch

If you want to try to implement this, I would suggest starting the application to change repayment plans at least a few months before filing your next tax returns after your residency ends.

You could also make the argument that in Scenario Four if the loan amount was smaller and the cap was lower, you would hit a point where IBR became a solution. This will only work in those rare cases where you come out of residency, and your income grows by more than six times your residency income, and you have a loan balance that is well below your income.

You will be much better served by understanding all of your payment scenarios up front. It will be a very rare case that you can help yourself by moving from SAVE to PAYE. Choose the correct payment plan now.

Hey there,

Thank you so much for your insight into the process of switching. This has been a very helpful article. I have a question regarding my situation-I graduated with approximately 330,000 in loans. I have been lucky enough to have never paid any money on my loans and the pause has been going on since starting. I still have 2 years in residency and 1 year of fellowship left-all of my training will go towards PSLF forgiveness so far which will be 6 years. I am going into a very high paying specialty and am looking to make around 500,000 my first year out according to recent graduates. I am currently on REPAYE plan and have 0 dollar payments at least through End of May 2023 without the pause. Would you recommend switching to PAYE after the end of 2023? I am not currently married but expect I will be by the time I finish training. Thanks for the help.

Hi Ryan,

We hope residency is going well for you so far!

The reason we sometimes advise clients to remain on REPAYE while in residency/fellowship is that REPAYE subsidizes a portion of any unpaid interest that would otherwise accrue on your loans while your income and payments are low. However, it sometimes makes sense for married residents or fellows to go to PAYE because PAYE allows them to exclude their spouse’s income from the payment calculation by filing separately on their taxes.

The risk to watch out for as noted in the article is that it may make sense to switch to PAYE just before finishing fellowship (even if not married) since PAYE also has a payment maximum, or “cap”, while your payments could continue to increase on REPAYE with your income after fellowship.

Hopefully that helps! Please feel free to schedule a call with our team if you have any questions specific to your situation.

Thank you so much for the help and response! My other question is that if I switch does the switching process delay my payments that are eligible for PSLF? I dont want to miss one single month while in training.

Thank you for your help!!

Hello there,

Thanks for publishing these articles! I’d love some advice on my situation…I’m going to be graduating from medical school on June 10 2022 with 447k of debt (combination of undergrad and grad) and I’d like to pursue the PSLF option. My plan is to consolidate them as soon as the grace period starts (June 13th perhaps) and take advantage of the zero monthly payments for the first year. My residency program is 3 years long. I’m single with no dependents and I don’t foresee getting married. Based on the studentaid.gov calculator, it seems as though the PAYE plan would be superior to the REPAYE plan for me. What do you think? Warm regards

Hi Jane,

Congratulations on graduating medical school!

PAYE and REPAYE have the exact same calculation for payments (10% of discretionary income) if you’re single. You could also qualify for PSLF after 10 years on either plan, as long as you meet the other requirements. The differences are in the details.

One benefit of REPAYE over PAYE is that if your interest is growing faster than your payments, the government will cover half of the remaining interest that would otherwise be added to your loans each month if you are on REPAYE. This is one of the few interest subsidies out there for unsubsidized student loans (such as graduate loans).

However, a danger of REPAYE which we discuss in the article is that it doesn’t cap your payments as your income increases. Under PAYE, your payments will always be limited to the 10-year payoff amount. You can get an idea of what this amount would be by looking at your payments under the 10-year standard repayment plan. REPAYE doesn’t have any caps on payments, so under REPAYE your payment could keep going up as your income rises after residency.

So there may be an advantage to sticking with REPAYE during residency to receive the interest subsidy. However, we always make sure to re-evaluate the right student loan repayment plan with clients every year, because which plan is better can change as your income increases or you get married or have children down the road. We also always keep an eye out for any changes to PSLF as well as refinancing opportunities as you grow into your career and life happens.

Hopefully that helps!

Hello Chris,

Great article. But I still have questions regarding my situation. I am finishing up my 3rd year of residency and will start a 3 year fellowship in July. I recently got married and my wife and I are both currently under REPAYE. Now she has another year of residency left before she starts as an attending and I have 3 more years til I finish fellowship. She has ~400k in student loans and I have ~200k. I was told sometime during medical school to switch from REPAYE to PAYE once we are married and to then file separately. Is this correct? When should I switch to PAYE?

Hi Paul,

Thanks for the feedback, and congratulations on your recent marriage!

REPAYE tends to be a great option for physicians during residency and fellowship, but one of the issues with staying on REPAYE longer term is that there is no cap on payments, so they will continue to increase with your income.

Switching to PAYE or IBR can be a better option longer term since both of these plans cap payments at the amount they would be under the 10-year standard plan as your income increases.

However, another key difference between REPAYE and IBR/PAYE is how they treat married filing separately. REPAYE will almost always use your combined household income (for both spouses) to calculate payments, and then divide the payments between the two of you based on your student loan balances. By contrast, IBR and PAYE will use only your separate income and loan balance to calculate payments if you file separately on your taxes.

That’s where it becomes difficult to figure out the best option for you and your wife without looking at your individual tax filing options, student loan histories, and income trajectories. It might make sense for you and your wife to stay on REPAYE, switch to PAYE or IBR, or a combination of both, with one spouse on REPAYE and the other on PAYE/IBR. It’s really hard to say without all of the details that we typically dig into.

Hello, and thanks for a great article. I currently have ~250K federal student loan @6.75% and I’ve been doing REPAYE for the last 3 years since I am the only person who is working (married). When I was at school, my loan officer advised me to stick into REPAYE for 19 years and change it into PAYE in 20th year so that I can benefit from REPAYE (he said, if I am going to be only person who will be working, but change it into PAYE if my wife starts to work)

My question is, will they still forgive my loan in 20th year even though I was on REPAYE for 19 years and PAYE for the last 20th year??

Eric,

Thanks for taking the time to reach out to us.

Keep in mind that with the REPAYE plan, the repayment period on undergraduate loans is 20 years, the repayment period on graduate loans is 25 years.

The following quote is from the “Income-Driven Repayment Plans: Questions and Answers” PDF from the StudendAid.gov site.

“Generally, a qualifying monthly payment for any of the income-driven repayment plans is a payment made under

any income-driven repayment plan, whether based on your income or the 10-year Standard Repayment Plan amount;

the 10-year Standard Repayment Plan; or

any other repayment plan, if the payment amount is at least equal to what the payment amount would be under the 10-year Standard Repayment Plan.

For example, if you began repayment under the 10-year Standard Repayment Plan and later changed to one of the income-driven repayment plans, the monthly payments you made under the 10-year Standard Repayment Plan will generally count toward the required 20 or 25 years of qualifying monthly payments for the income-driven repayment plan. Similarly, if you were previously in repayment under one incomedriven repayment plan and later switched to a different income-driven repayment plan, payments you made under both plans will generally count toward the required years of qualifying monthly payments for the new plan.”

As long as you are on a valid Incoem Drive Repayment plan, you should be in good shape.

I hope this helps!

Chris Hansen

Hi Chris,

I will be completing my residency this year with ~$200,000 in student loan debt. I am in REPAYE and newly married to another resident, therefore my payments are now based on our combined income (~800 per month). I will be starting a 3 year fellowship in July, and my husband will be starting an attending position with a high salary. I am wondering if I should switch to IBR (I do not qualify for PAYE) so that we can file our taxes separately and only use my low fellowship income. After I complete fellowship my salary will likely be high, so can we can then file jointly and take advantage of the payment cap? Is my logic correct?

Also, is the payment cap based on what you would pay under the 10 year plan regardless of when you switch to IBR? I read somewhere that if you switch to IBR after making for instance 4 years of payments, than they calculate the cap by dividing your balance over 6 years. Is this true?

Hi Christine,

Congratulations to you and your husband. You have worked extremely hard to accomplish what you have.

Without having all of the details, your plan sounds pretty solid. A couple of things to watch out for:

– When your salaries are similar, married filing separately (MFS) typically results in slightly lower taxes. If your salaries differ substantially (they will for the next three years), the tax impact of MFS can be significant. You will need to run your tax projections by a CPA to make sure you understand the MFS cost.

– I assume your husband has no federal student loans. If he does, keep in mind that his loans will be included in both of your REPAYE calculations.

– With the 15% IBR payments, plus the MFS taxes, you may find that you are okay sticking with the REPAYE married filing jointly payments.

You are very close in your understanding of the payment cap adjusting after making income driven repayments (IDR). The 10-year standard repayment cap and calculation is initially based on your starting student loan debt on the date you start repayments. The start date never changes, but the repayment calculation and cap does. If you make four years of payments on a significantly lower IDR plan, and then switch, the 10-year standard repayment cap and calculation are amortized over the remaining six years. The interest must be included in your calculation. The repayment schedule needs to take the entire balance due to zero after the remaining six years.

I hope that makes sense.

Chris Hansen, CFP®

Hi Chris and Christine,

One point of clarification that may help Christine (although I am a year late!), is that while it is true that the Standard Repayment schedule needs to take the entire balance to zero after the remaining six years, if she were to delay her switch to IBR later (or worse, not qualify) before earning the higher salary, then cap may be amortize to the remaining 4 or 5 years. So it’s better to switch to IBR early i this scenario.

– David

David,

Absolutely. Start the process well before the time your salary increases.

Chris Hansen

Hi Chris,

I am in my 1st year of residency and my loan deferment period is about to end next month. I need to apply for a repayment plan ASAP! My total debt is ~420k (unconsolidated, avg interest rate of 6.09%) and I am in a pediatrics residency unsure of whether or not I will be pursing fellowship. I am planning on applying for PSLF.

I am stuck between REPAYE and PAYE. My biggest fear is what will happen when my fiance and I get married. He has a high income and low (almost negligible) debt. We are still unsure of whether we will be getting married while I am in residency or after graduation, so I was thinking about starting with REPAYE and switching to PAYE either before we get married or before graduation (to take advantage of the plan’s ability to file taxes separately and its payment cap), whichever comes first. I figured starting with REPAYE would be beneficial, as it would allow me to make use of the interest subsidy initially. I also have a fear of the PSLF program ending, so I feel that REPAYE’s interest subsidy will allow me to make a bigger dent in my debt while still making minimal monthly payments. Do you think this would be the best option for me or do you think there is a better way of going about this? Would switching from REPAYE to PAYE either before getting married or before graduation affect my PSLF status – would my 120 payments towards PSLF restart? Would interest capitalize if I make the switch?

I appreciate your help!

Hi Lora,

You are asking the right questions. The decision between RePAYE and PAYE is based on balancing the payment cap of PAYE with the interest forgiveness benefit of RePAYE.

If I assume three years of residency for Pediatrics and an income of $180,000, you will be a long way from the 10-year payment cap of around $4,680. Your fiancé’s income would need to be approximately $300,000 to hit the cap MFJ. If their income is substantially over $300,000, the PAYE cap will be beneficial.

If you switch from RePAYE to PAYE before you get married, the interest that has accrued will capitalize, be added to your original principal, and start being charged interest.

If you are in PAYE, the difference between MFJ and MFS would be around $2000 to $3,000, based on my income guesses. The increase in income taxes could quickly overshadow the difference in payments.

Switching Income Driven Repayment plans does not impact your PSLF status. The previous eligible repayments will still be counted.

There are a lot of variables to take into account here. Ultimately, if you get PSLF, both paths work. Without having all of the facts and doing a complete student loan analysis, I really can’t get much closer than the comments above.

I hope this helps!

Chris,

Great information on your blog here..I’m finishing residency in two months. I have approximately 390k (6.8-8%) in student loans and my wife has ~120k (6.8-8% as well). She is a teacher and has been making small payments on her loans. Mine have been in forbearance the last 8 years (medical school and residency). I’m starting a new job in July and making 250k. I’m not sure how to proceed and which repayment plan would be best. Thanks for any guidance!

Jason,

Congratulations on reaching the next milestone on your journey!

I would recommend you apply for an Income Driven Repayment plan Today! Your next 12 monthly payments will be based on your current income, not on the $250k income.

It is going to be very difficult to pay off $510k in debt on $250k and a teacher’s salary. You need to run the numbers yourself or hire somebody to do it for you, but I would think that RePAYE is going to be your best option. Your 10-year standard repayment is probably around $4,000-$4,500 a month. That’s just for your loans, it doesn’t include your wife’s loans. Assuming your wife makes around $60k and you both get 5% raises, your RePAYE payment will not go over $3,000 in the next 10 years. That means you will not benefit from a repayment cap from PAYE or IBR. This option also presents the least amount of risk because they will forgive 50% of the unpaid interest every month.

Please go tell every resident you meet to start the PSLF process now. Tell them to read my post on what to do as soon as your graduate from Medical School. Do not wait until they are out of residency. Payments during residency will count toward forgiveness and will generally only be a couple hundred dollars. I know that’s tough to do on a $50k salary but it will save a ton of money. Also, if you are already in the PSLF program, you will most likely get grandfathered if they eliminate it.

I hope this helps!

My fiance and I are both graduating medical school with, both plan on pursuing 3-yr residencies (IM and Peds) and both plan on PSLF. She may or may not do a 3yr fellowship. We will be married in our 2nd year of residency. My question is, since we will eventually be married as R2’s, should we just both go into PAYE right now and forever, or would it help to both go into REPAYE and then switch to PAYE prior to graduation (or even sooner as I believe there’s a closed tax loop hole when married filing separately/jointly). I know this sounds confusing, I just want to know which option (PAYE vs REPAYE) is best.

Thank you for any help/guidance

Me: $275K loans (IM)

Her: $225K loans (Peds)

Charles,

If you start out in RePAYE, you save 50% of the unpaid interest, which will keep your overall debt amount lower. If you do find that it is beneficial to file your taxes married filing separately and switch to PAYE, I would suggest you do it during your second or third year of residency. Remember, your payments are based on last year’s tax returns. Your marriage won’t be reported until you are R3’s.

It’s challenging to predict what the tax penalty will be in three years for married filing separately. Your difference in payments will not be significant, given the data you have shared. Also, in three years, you will have a better idea of how realistic PSLF is for both of you. If the savings in student loan payments is roughly equal to the losses due to higher taxes, I always lean toward paying the money toward the loans.

Realistically, you are going to need to address this question every year as you both go through residency.

Good luck!

Chris Hansen, CFP®