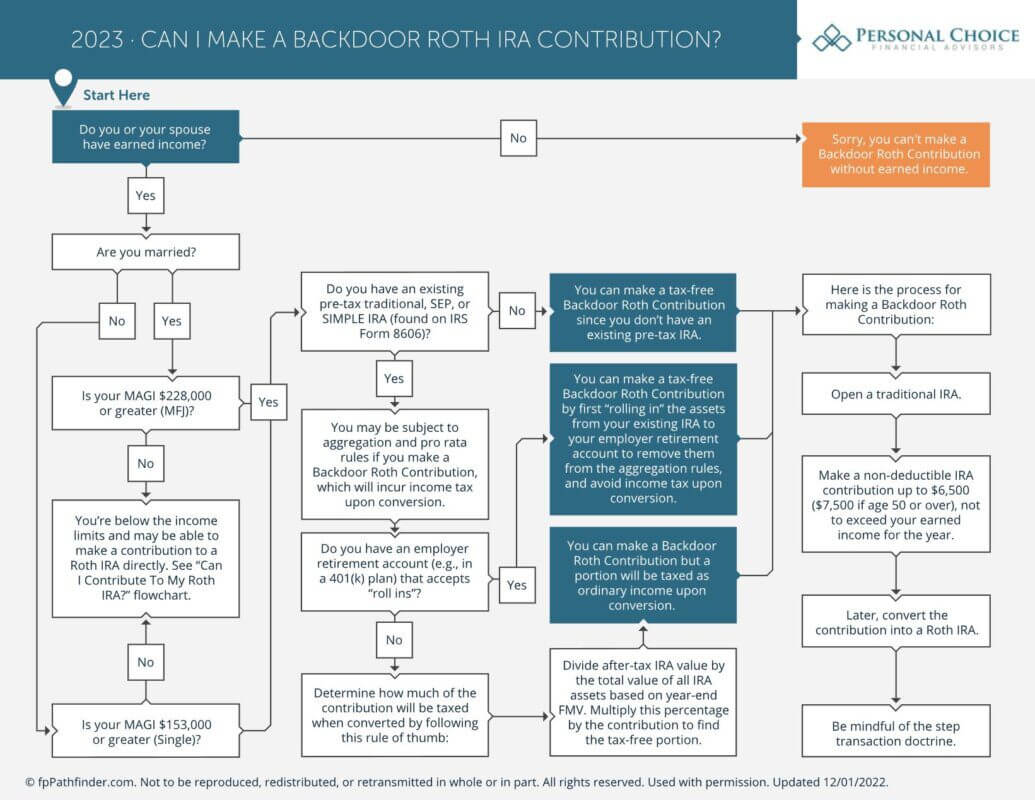

As a physician, you’ve dedicated years to your education and training, and your high income reflects the value of your expertise. However, when it comes to saving for retirement, you may find yourself ineligible for Roth IRAs due to income limits. The income limits for 2023 are $153,000 for single and $228,000 for married physicians filing jointly on your taxes. If you’re married and file separately on your taxes, the limit is only $10,000.

But there’s a solution tailored just for you: the Backdoor Roth IRA. This blog post will discuss the ins and outs of this lesser-known yet completely legal, tax-advantaged investment strategy for physicians.

The entire strategy is based on the fact that although there are income limits for contributing directly to a Roth IRA, there are no income limits for converting a traditional IRA to a Roth IRA.

What is a Backdoor Roth IRA?

A Backdoor Roth IRA is a method physicians can use to contribute to a Roth IRA indirectly. The process involves making a nondeductible contribution to a traditional IRA, then converting that amount to a Roth IRA. This allows you to bypass the income restrictions that would typically prevent you from directly contributing to a Roth IRA.

Why Should Physicians Use a Backdoor Roth IRA?

- Tax-free growth and withdrawals: One of the main reasons to consider a Backdoor Roth IRA is the tax benefits. Roth IRA contributions grow tax-free, and qualified withdrawals in retirement are also tax-free. Given the typically high tax brackets for physicians, this strategy can result in substantial savings.

- No required minimum distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have required minimum distributions once you reach a certain age. This means you can leave your investments in the account to grow for as long as you want, providing you more control of your taxes during retirement.

- Estate planning advantages: Roth IRAs can also provide estate planning benefits, as your beneficiaries can inherit the account without being subject to income tax on the distributions. Once a Roth IRA passes to your heirs, it will be subject to RMDs.

How Physicians Can Execute a Backdoor Roth IRA

- Contribute to a traditional IRA: The first step is to make a nondeductible contribution to a traditional IRA. This means that you do not receive a tax deduction for the contribution. The maximum contribution limit for 2023 is $6,500, or $7,500 if you are 50 or older.

- Convert the traditional IRA to a Roth IRA: Once the contribution is made, you can then convert the traditional IRA to a Roth IRA. This involves transferring the funds from the traditional IRA to a Roth IRA account. You’ll need to pay taxes on any earnings generated between the time of contribution and conversion, but the initial non-deductible contribution will not be taxed again.

- Mind the pro-rata rule: The pro-rata rule will apply if you have pre-tax dollars in other traditional IRAs. This rule states that the conversion must be done proportionally between pre-tax and after-tax balances, which could result in a higher tax bill. To avoid this issue, consider rolling over pre-tax IRA balances into an employer-sponsored retirement plan, like a 401(k) or 403(b). Another great option is to roll any traditional IRAs into a Solo 401(k) if that option is available to you.

Reporting Backdoor Roth IRA Contributions on your Taxes

After making a Backdoor Roth IRA contribution, you need to report the contribution on your taxes on Form 8606. If Form 8606 is not filed, you could pay a penalty and risk being taxed twice on your contributions if your basis is not properly documented.

The IRS’s instructions for Form 8606 state that the form should be filed to report non-deductible traditional IRA contributions, as well as Roth conversions. For a Backdoor Roth contribution, you’ll need to report the traditional IRA contribution step in Part I of the form, and the Roth conversion step in Part II.

Note: while you’ll receive a 1099-R for the Roth conversion from your IRA provider, you typically won’t receive any official documentation for your IRA contributions until after your taxes have been filed. You will need to tell your tax preparer about both the contribution and conversion steps, which need to be reported in different places in the tax software to complete Form 8606.

Common Mistakes when making Backdoor Roth IRA Contributions

- Pre-tax dollars in traditional IRAs: To avoid paying taxes on your Backdoor Roth IRA contribution, you cannot have any “pre-tax” IRA money as mentioned above. If you do, you may be able to roll any pre-tax IRA balances into a 401(k), 403(b), or Solo 401(k) tax-free before you begin making Backdoor Roth IRA contributions.

- Withholding taxes on the Roth conversion: Remember that your Backdoor Roth IRA contribution should be a tax-free event. If you withhold any taxes during the conversion step, the tax withholding will be considered a taxable distribution and may be subject to additional penalties if you are under age 59 1/2. To avoid this, make sure you “opt out” of tax withholding when requesting the Roth conversion from your IRA provider.

- Not reporting the IRA contribution: As mentioned above, you may not receive any official tax forms for your IRA contribution, but you need to report this on your taxes for the conversion to be tax-free. If you only report the Roth conversion on your taxes and don’t report the IRA contribution separately, the conversion will be taxable.

Conclusion

How Physicians Can Execute a Backdoor Roth IRA

A Backdoor Roth IRA can be a powerful tool for physicians looking to maximize their tax-advantaged retirement savings. By understanding the process and the benefits associated with this strategy, you can make more informed decisions about your financial future. As always, we recommend consulting with a financial advisor or tax professional to ensure you execute the Backdoor Roth IRA strategy correctly and in line with your unique financial situation.

Leave a Reply